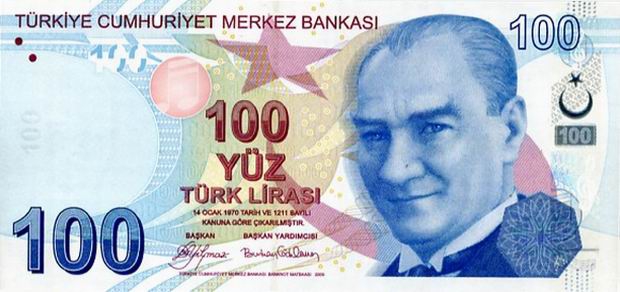

The first foreign exchange swap in the Iranian rial and Turkish lira came on Tuesday after months of anticipation, which followed an agreement signed last year to use local currencies in trade.

�Given the signing of an agreement for forex swap in Iran�s rial and Turkey�s lira between Iranian and Turkish central banks, the Central Bank of Iran opened the first letter of credit (LC) on April 17, 2018 to finance trade with Turkey,� the bank said in a statement.

The CBI said its agenda was to seal other deals for forex swap in local currencies with the countries which have major transactions with Iran.

The aim is to �facilitate trade with neighboring countries, channel forex operations of natural and legal persons via the banking system, make use of international payment instruments and reduce risks in foreign exchange operations�, it said.

Iran is under unilateral US sanctions, which have complicated transactions in dollars because they have to be processed through the American financial system.

Turkey is not under any specific sanctions but its rising tensions with the US and the Europeans over their support for Kurdish militants in Syria and other issues have made traders jittery and affected the country�s economy.

Last week, the lira touched an all-time low to the US dollar and the euro, while the rial hit an all-time low of 62,000 against the US dollar on the unregulated market before the government intervened and set a unified rate of 42,000.

Energy Minister Alexander Novak said last Monday Russia was considering payments in national currencies in trade with Iran and Turkey.

PressTV-Russia, Iran, Turkey mobilize in currency war

Iran and Turkey signed an agreement last year to use local currencies in trade while Tehran and Moscow discuss a similar arrangement.

�There is a common understanding that we need to move towards the use of national currencies in our settlements. There is a need for this, as well as the wish of the parties,� Russian broadcaster RT quoted Novak as saying.

Officials in both Iran and Russia have said they were speeding up work on reducing dependency on US payment systems and the dollar as a settling currency.